The Acquisition Challenge

When our logistics client considered acquiring a smaller logistics firm, they requested a comprehensive IT infrastructure assessment before finalising their investment. The target company operated with minimal IT oversight, raising immediate questions about hidden costs and security risks.

Our initial review revealed a concerning picture: the company’s critical server – managing all business operations including accounting – was running on a desktop computer.

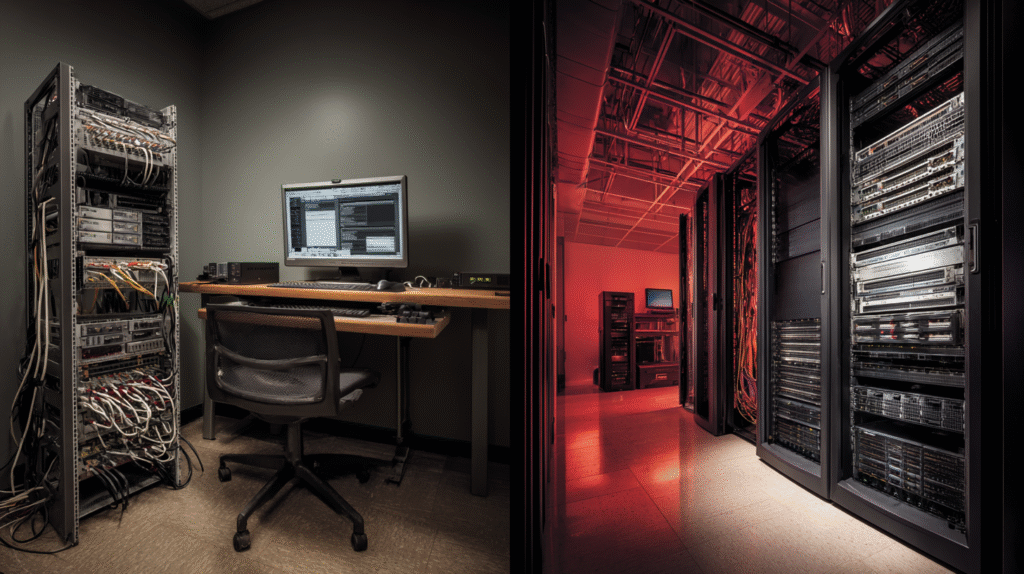

The broader infrastructure showed similar patterns. Mixed workstations running unsupported systems, unmanaged networking equipment, manual backup processes, and no enterprise security measures. For a company handling logistics operations, these gaps represented significant business continuity and operational risks.

Our Assessment Approach

Acquisition due diligence requires more than identifying current problems. We evaluate infrastructure through business continuity and growth readiness perspectives, examining how technology limitations could impact post-acquisition integration and operational efficiency.

Our systematic assessment focussed on four critical areas:

- Security posture evaluation: Identifying vulnerability exposure that could create compliance risks or security incidents post-acquisition.

- Business continuity analysis*: Evaluating single points of failure that could disrupt operations during integration phases.

- Scalability framework review: Determining infrastructure capacity to support our client’s operational standards and growth projections.

- Integration pathway planning: Mapping technical requirements for bringing acquisition infrastructure in line with parent company standards.

What We Discovered

The assessment revealed infrastructure that could potentially operate short-term but represented significant hidden acquisition costs. The desktop masquerading as a server exemplified the broader challenge: systems that appeared functional but lacked the redundancy, security, and scalability required for business growth.

Critical findings included:

- Critical server on inappropriate hardware*: The OMNI server running on desktop-class equipment with no redundancy – single power supply, no ECC memory, desktop storage – creating high downtime and data loss risks.

- Inconsistent security posture: Mix of systems with missing patches, outdated protection, and no centralised management across the organisation. No security hardening standards, unrestricted user privileges, and lack of device management created multiple vulnerability exposure points.

- Manual backup processes: No automated, encrypted backup systems with external storage for business continuity.

- Unstructured networking: Consumer-grade equipment and unmanaged infrastructure that did not meet best-practice compliance standards.

Strategic Recommendations

Our recommendations addressed both immediate risks and long-term scalability requirements:

- Server infrastructure modernisation: Migrate the OMNI server to enterprise hosting environment with automated backups, disaster recovery, and proper redundancy.

- Security baseline establishment: Implement enterprise-grade firewall, centralized device management, and standardized security protocols across all systems.

- Network infrastructure upgrade: Deploy structured cabling, managed networking equipment, and secure remote access capabilities for integration requirements.

- Standardised endpoint management: Replace mixed workstation environment with standardised, centrally managed systems supporting the parent company’s productivity standards.

Business Impact Assessment

Our evaluation provided our client with accurate post-acquisition IT investment requirements. Rather than discovering infrastructure limitations after ownership transfer, they could factor comprehensive technology upgrade costs into acquisition planning and negotiation.

UK acquisition assessments must consider GDPR compliance implications and data handling requirements that affect post-acquisition integration timelines.

The comprehensive evaluation demonstrated the difference between acquisition IT assessment and standard hardware auditing. While hardware vendors focus on equipment replacement and basic functionality, strategic assessment examines how infrastructure limitations impact business integration and growth objectives.

The comprehensive evaluation demonstrated the difference between acquisition IT assessment and standard hardware auditing. While hardware vendors focus on equipment replacement and basic functionality, strategic assessment examines how infrastructure limitations impact business integration and growth objectives.

Competitive Advantage Through Strategic Assessment

Most acquisition due diligence treats IT as a compliance checklist rather than business enablement evaluation. Our approach examines infrastructure through industry-specific operational requirements, identifying not just current limitations but future scalability constraints.

This methodology protects acquisition investments by revealing hidden costs before ownership transfer. It enables buyers to make informed decisions about technology integration timelines and budgets, preventing post-acquisition surprises that could impact business operations or integration success.

When acquiring businesses, technology assessment should protect investment decisions, not just document current state.